The New Faces of Licensed Brands

The new faces keep on arriving — television hosts Ellen DeGeneres and Kelly Ripa, reality star Countess LuAnn, “Pioneer Woman” Ree Drummond and country superstar Trisha Yearwood. All have recently marched into the soft home business, and more of their colleagues will surely follow.

Reflecting the changing nature of the marketplace, some of them are licensed directly to major retailers, others diffused out to a roster of suppliers. They also demonstrate the fact that how licensed brands come to market and what’s expected of the players involved has changed dramatically.

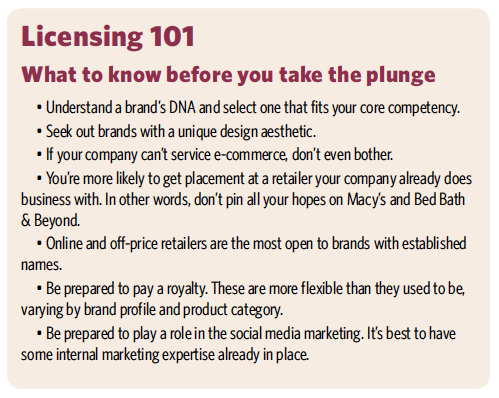

The particulars of licensing agreements today are tailored by brand and product category, said Carolyn D’Angelo of Iconix Brand Group, whose soft home brands include Royal Velvet, Cannon, Fieldcrest, Charisma, Rampage, Waverly and Peanuts.

“Every single deal is custom. There is no one flat fee, no minimum standard,”said D’Angelo, evp brand management and marketing services. “There’s so much more flexibility than even five years ago.” It’s become more difficult to command guaranteed minimums for advance “unless it’s a Triple A brand,” added Jeffrey Cohen, ceo, earthbound, which recently relaunched the Portico and Under the Canopy brands in soft home. “Suppliers don’t want to be shackled to a minimum. They’d rather invest in marketing.”

That marketing piece has become increasingly important — particularly in the age of social media — shifting the level of commitment expected from licensees, Beanstalk ceo Allison Ames told H&TT .

“It’s no longer just about generating royalties on sales of branded products. Commitments to significant marketing spends are becoming increasingly more important in licensor-licensee relationships,” said Ames, whose global licensing agency forges partnerships among brands, celebrities, media properties, manufacturers and retailers.

For the licensors themselves, the difference in the financial return of brand ownership vs. the more traditional licensing agent model can be significant, said Kerry Glaser, president, Concept Marketing Group.

“An agent’s commission for providing ‘outside’ consulting services is typically defined as a percentage of wholesale product sales or in some cases a percentage of the total royalty,” noted Glaser, who recently struck a bedding and bath licensing deal for Real Housewife celebrity Luann de Lesseps.

“Ownership income formulas are many and represent multiples of the agent’s income — the key reason why some companies are opting to purchase the brand to derive a greater return on what can be a protracted timeline to product launch.”

E-Comm: A Springboard or a Sinkhole?

Jewel Branding & Licensing places a premium on licensees going into production, so it will sometimes forgo minimums or scale them way down if suppliers agree to push licensed goods out online.

“Retailers aren’t committing to putting much on the floor. If it does well online, they may test it in stores,” said president Julie Newman, whose portfolio of bedding licenses includes Collier Campbell and Blissliving Home.

Home textiles veteran Greg Wyman, who partners with Jewel on retail business development, said e-commerce has changed the business exponentially. “Consumers are not being dictated to. They are seeking out something that speaks to their own point of view,” he said. “In 2000, the shopping bag that you brought home meant something. Now it’s a box that arrives at your door.”

Sequential Brands Group — whose brands with a home presence include Caribbean Joe, Ellen Tracy, Jessica Simpson, Martha Stewart and Emeril Lagasse — develops an authorized list of online sites where licensees may place a particular label. The doors aren’t closed for other e-comm operations, but will be reviewed on a site by site basis.

“The key point is if [the site] carries comparable competitive brands — and it doesn’t have to be home,” said Rick Platt, president of Sequential’s lifestyle division. “It’s all about the competitive set. You’ve got to be really flexible.”

Brands are attractive for online selling because they’re searchable — and often supported by social media campaigns to drive up awareness. Licensors said retailers are particularly hungry for brands with a national profile.

“A lot of online developers will put up whatever you have. But it’s a balance because you don’t want to have so much out there that it gets lost among everything else,” said Newman. On the up side, e-commerce is forcing retailers to think outside the box, literally. But there’s a caveat.

“E-commerce, which is not ideal for all home categories, needs to be incorporated as part of a total plan, including consistent messaging to enhance the shopping experience from the in-store visual display to sales associates who can effectively help a customer’s understanding of their design options,” said Glaser. “Integrating consistency across all media platforms is essential in competing for the attention of the consumer in today’s digital community.”

The Authenticity Factor

Before taking on a brand, potential licensees need to get a full understanding of the brand’s qualities and value. Does it emotionally connect with consumers? Which consumers? Is it relevant to what’s trending at retail? Is the design aesthetic unique? And can it cross multiple categories?

“It’s all about the anchor categories: bedding and furniture. These two important decorative areas of a brand are critical to properly interpreting and expressing a brand’s voice,” said Ames.

Once those categories are established, brand owners and agents look to “wraparound” home products such as lighting, home décor, wall coverings, paint, and rugs, she added.

“The first thing for a licensee is deeply understanding what the brand is about, where it’s sold and whether it makes sense in the product category they’re in,” said D’Angelo. “And suppliers really should understand the marketing of the license and what the owner is going to spend to support the brand.”

Brand owners and agencies are also interested in extending into retail formats that aren’t crowded with captive brands and private labels — including drug stores, supermarkets and other non-traditional chains.

“We look at the full landscape and see if there’s a white space. There’s no point trying to push a brand into a retailer that doesn’t need it or doesn’t have the right customer make-up for the brand,” said Cohen. He noted that retailers are more likely to take on a brand from suppliers that have serviced them well on other product. “It’s so difficult today to get on a retailer’s matrix. Unless you have a blockbuster brand, it’s not automatic.”

The volatility of the landscape promises to open more opportunities, several licensors believe. The struggle to strike the right balance between bricks and clicks — indeed, the challenge of rethinking how a physical retail store should be constructed and what it should provide – has upended the old formulas. “There’s a creative force coming into the industry and shaking things up,” said Wyman. “It’s a good time.” H&TT